An Activist Investor Takes on BlackRock Over E.S.G.

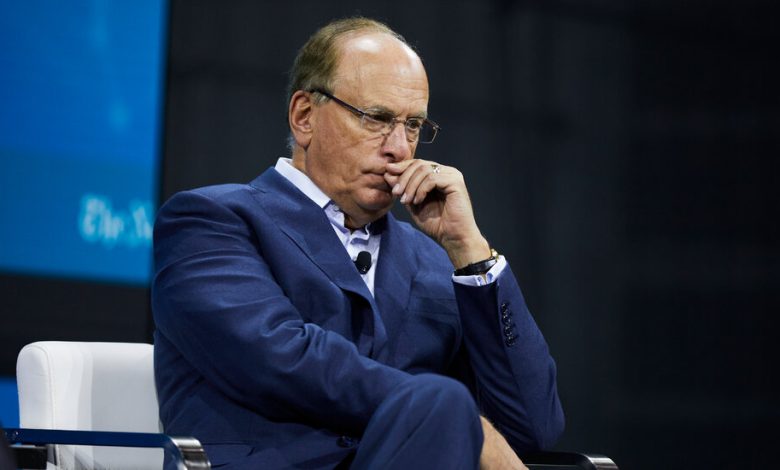

Larry Fink, under pressure on E.S.G.Credit…Winnie Au for The New York Times

BlackRock draws an activist investor who wants Fink out

In recent years, BlackRock has become one of the most prominent voices in support of investing in accordance with environmental, social and corporate governance — or E.S.G. — principles. That approach has drawn support from environmental activists, as well as growing political blowback, largely from Republican politicians and activists who accuse the firm of imposing progressive policies on state funds.

Now, Bluebell Capital Partners, a $250 million hedge fund with a history of taking on big companies, is demanding that BlackRock rethink its approach to E.S.G., and it’s called on the firm’s C.E.O., Laurence D. Fink, to step down.

Bluebell accused BlackRock of both hypocrisy and overstepping its bounds in a letter sent to the firm’s board last month that was reviewed by DealBook:

-

On the former, the hedge fund said BlackRock had flip-flopped on whether to invest in companies involved in coal meant for energy production, including the mining giant Glencore, which moved to increase its production of thermal coal this year. Bluebell also said BlackRock declined to join its campaign to stop the Belgian chemical company Solvay from dumping soda ash into the Mediterranean Sea.

-

But Bluebell also said that “it is not BlackRock’s role to direct the public debate on climate and energy policies or to impose ideological beliefs on the corporate world.” The hedge fund said BlackRock’s E.S.G. push had become politicized and a distraction, as several Republican state officials have moved to withdraw funds from BlackRock in protest.

“BlackRock has become a source of E.S.G. risk,” Giuseppe Bivona, a co-founder and co-chief investment officer of Bluebell, told DealBook. By becoming a big target of conservative ire while also failing to step up in some E.S.G. situations, BlackRock has put its clients’ investments at risk.

BlackRock has come under increasing pressure from red states that oppose its embrace of E.S.G. causes. Last week, Florida said it would pull $2 billion in state pension funds out of BlackRock. At the DealBook Summit last week, Mr. Fink defended BlackRock’s commitment to the E.S.G. approach. “I think stakeholder capitalism is not political or woke — I just think it’s capitalism,” he said.

BlackRock said in a statement: “In the past 18 months, Bluebell has waged a number of campaigns to promote their climate and governance agenda. BlackRock Investment Stewardship did not support their campaigns as we did not consider them to be in the best economic interests of our clients.”

BlackRock is the biggest target yet for Bluebell, which has won some victories at major targets. The hedge fund led a campaign to oust the C.E.O. of Danone, the French food conglomerate, in 2021, and struck a settlement with Solvay over its chemical dumping. More recently, Bluebell ran an unsuccessful effort to revamp the board of Richemont, the owner of luxury brands like Cartier.

That said, it’s unclear how much effect Bluebell’s efforts will have. The relatively small hedge fund is unlikely to own more than a tiny stake in BlackRock, whose market value as of yesterday was nearly $107 billion. (Mr. Bivona declined to say how big his firm’s stake was.)

HERE’S WHAT’S HAPPENING

Raphael Warnock wins re-election in Georgia’s Senate run-off. His victory over Herschel Walker solidified Democrats’ control of the upper chamber with 51 seats, making it easier to confirm President Biden’s political and judicial nominees.

Donald Trump’s family business is convicted of tax fraud. Jurors in a New York State court took just a day to find the Trump Organization guilty on 17 criminal counts, including failing to pay taxes on lavish perks doled out to executives. The verdict could embolden other investigations into Trump and complicate his 2024 presidential run.

China issues a broad easing of pandemic restrictions. The moves include reducing the frequency of required Covid testing and allowing those with mild or asymptomatic infections to isolate at home, instead of at a hospital. Beijing’s zero-Covid policies led to widespread protests and weighed heavily on the Chinese economy.

Theranos’s former president is set to be sentenced on Wednesday. Sunny Balwani faces as much as 17½ years in prison for his role in fraud committed at the collapsed blood-testing start-up. He could end up with a longer punishment than his former boss and partner, Elizabeth Holmes, who was sentenced to 11¼ years last month.

No longer banking on good times

Banks have gone from watching the clouds roll in to battening down the hatches, as Morgan Stanley becomes the latest on Wall Street to make cuts to its work force.

Banks are preparing for leaner times. Morgan Stanley on Tuesday laid off about 1,600 workers, or 2 percent of its staff. That followed cuts at Barclays, Citigroup and Goldman Sachs. Even those left behind are set to feel some pain: Bonuses are expected to be down by as much as 45 percent, according to the compensation firm Johnson Associates.

Wall Street thinks the economy will get worse. Bank C.E.O.s at Goldmans Sachs’s annual financial services conference this week are worried about the global economy, as consumer spending dries up and there are warning signs of a slowdown in 2023. The talk of tough times ahead spooked investors; the S&P 500 fell for a fourth straight session yesterday, and U.S. futures were trading lower at 7 a.m. Eastern today.

Goldman’s C.E.O., David Solomon, said he was more cautious about the economy than even his own economists. He warned of further weakness in the labor market and signaled that Goldman may have to trim headcount as well. Brian Moynihan, Bank of America’s C.E.O., said that the bank wasn’t laying anyone off but that it had imposed a hiring freeze.

Inflation and geopolitics will hit the economy as stimulus savings dry up. JPMorgan Chase warned that things would get worse once savings from stimulus checks are spent, with Marianne Lake, the co-chief of its consumer business, saying the average consumer is likely to be tapped out by the middle of next year.

Jamie Dimon, JPMorgan’s C.E.O., told CNBC that inflation could cause a recession, as the Fed is set to raise rates to 5 percent and geopolitical worries hang over the economy. “Those things may very well derail the economy and cause this mild or hard recession people are worried about,” he said.

Meta case tests Biden’s new antitrust strategy

At a court hearing beginning on Thursday, lawyers for the F.T.C. will rely on little-tested legal arguments to urge a judge to block Meta’s $400 million acquisition of Within, a virtual reality start-up.

The case will be the latest test of a change in strategy embraced by President Biden’s antitrust regulators: They’re not afraid to lose. Instead, they’re aiming to stretch the application of antitrust law, writes David McCabe for The Times.

Meta is facing increased regulatory pressure on both sides of the Atlantic. It appears the E.U. will force Meta to change the way it serves targeted ads across its platforms to more closely align with the region’s tougher opt-in regime, in a closely watched data protection case, Reuters reports.

The F.T.C. will argue that Meta’s acquisition could hurt competition in the future, in contrast to the more common antitrust argument that a deal would hinder trade today. The F.T.C.’s case against Meta also stands out because Within, the maker of a fitness game called Supernatural, is a fairly small company related to a nascent part of Meta’s business, its metaverse efforts.

Regulators may still count a loss as a win. Progressives have long argued that the government isn’t tough enough on companies that are consolidating power because it is afraid of losing cases, so instead it enters weak settlements.The F.T.C. chair, Lina Khan, said at a conference in April that losing cases could signal to Congress that antitrust laws should be updated for the modern economy. If “there’s a law violation and the current law might make it difficult to reach, there’s a huge benefit to still trying,” she said.

“We’ve already had a few people ask us when the I.P.O. window reopens. We don’t even think about it. The answer is not soon.”

— Eric Boyle, a partner at Quest Partners, an adviser to technology firms, on the dismal state of venture capital dealmaking and the I.P.O. market in Europe. In its annual report, Atomico, a V.C. firm, says valuations of European tech startups have hit a five-year low.

Bankman-Fried and one of his top execs lawyer up

As authorities investigate the collapse of the crypto exchange FTX and its trading arm, Alameda Research, its founder Sam Bankman-Fried and one of his chief lieutenants, Caroline Ellison, are reportedly beefing up their legal defense teams.

According to Reuters, Mr. Bankman-Fried has hired Mark Cohen, a former assistant U. S. attorney for the Eastern District of New York who heads Cohen & Gresser’s white-collar defense practice. Cohen & Gresser recently defended the British socialite Ghislaine Maxwell in her sex-trafficking trial.

Mr. Bankman-Fried, whose crypto empire imploded last month, losing customers and investors billions, had been represented by Paul, Weiss, Rifkind, Wharton & Garrison, before the two sides parted ways in recent weeks.

Meanwhile, Ms. Ellison, who ran Alameda, has hired the Washington firm Wilmer Cutler Pickering Hale and Dorr, Reuters reports.

Elsewhere in crypto today:

-

Digital asset prices continue to flatline, with Bitcoin hovering around $16,800, down 1 percent in the last 24 hours. Yesterday, Jamie Dimon, the C.E.O. of JPMorgan Chase, called crypto a “sideshow,” likening crypto tokens to “pet rocks.”

-

The hedge fund Fir Tree Capital Management is suing Grayscale Investments, a digital assets fund whose crypto holdings were hit hard by FTX’s collapse. Fir Tree has accused Grayscale of conflicts of interest and of mismanaging its $10 billion Bitcoin Trust fund.

-

Signature Bank, a U.S. lender whose stock soared last year during the crypto bull market, said it plans to offload $10 billion worth of deposits tied to digital assets.

THE SPEED READ

Deals

-

NRG Energy will buy Vivint Smart Home, a smart thermostat maker, for $2.8 billion as it looks to diversify beyond electricity generation. (Bloomberg)

-

Fanatics, the sports start-up founded by Michael Rubin, has reportedly secured $700 million in funding that values the firm at $31 billion. (CNBC)

-

Chamath Palihapitiya, once known as the “SPAC king,” blames the Fed for the end of the investor mania in SPAC startups. (NYT)

Policy

-

Microsoft will allow Nintendo users to play Call of Duty on the rival videogame platform, agreeing to the concession as it tries to win regulatory approval for its $69 billion deal for Activision Blizzard, which owns the game franchise. Microsoft also plans to meet on Wednesday with the F.T.C.’s chair, Lina Khan, about the deal. (NYT, Bloomberg)

-

The E.U. will bring two cases against China — involving export restrictions and patent enforcement — to the W.T.O. after negotiations broke down. (Bloomberg)

-

A U.S. district judge threw out a lawsuit claiming the heartburn drug Zantac causes cancer, handing a victory to the drugmakers GSK, Pfizer, Sanofi and Boehringer Ingelheim. (Reuters)

Best of the rest

-

Apple is reportedly scaling back its self-driving car program, and pushed back the potential debut of the vehicle to 2026. (Bloomberg)

-

Ken Griffin treated 10,000 workers at Citadel and their families to a weekend at Disney World to celebrate his financial empire’s good year. (Reuters)

-

“If there is a ‘male malaise’ with work, could one answer be at sea?” (NYT)

-

Tech firms look to capitalize on the Elon Musk-induced chaos at Twitter. (NYT)

We’d like your feedback! Please email thoughts and suggestions to [email protected].