Binance Faces Mounting Pressure as U.S. Crypto Crackdown Intensifies

For years, the giant cryptocurrency exchange Binance has had a reputation for dodging regulators and skirting financial rules, all without significant consequences.

Now the world’s largest crypto exchange is facing mounting legal pressure.

Changpeng Zhao, Binance’s founder and chief executive, has hired white-collar defense lawyers at the law firm Latham & Watkins to represent him personally, as he and his company face a tightening legal net. Justice Department prosecutors are investigating the exchange for money laundering violations, as the Securities and Exchange Commission is looking into the company’s business practices. Last month, another agency, the Commodity Futures Trading Commission, sued Mr. Zhao, accusing him of compliance failures that allowed criminals to launder money on Binance.

The legal threats have converged to create the most precarious moment in Binance’s history. Criminal charges against Mr. Zhao or his company could set off mass panic in the crypto markets, which are reeling from the FTX exchange’s collapse last year and the arrest of the firm’s founder, Sam Bankman-Fried. Binance is several times larger than FTX was, processing tens of billions of dollars in trades every day.

“It’s the biggest exchange for crypto, and if it gets clamped down on, that’s going to be a big deal,” said Hilary Allen, a crypto expert at American University. “It’s hard to see the rest of the crypto industry remaining unscathed.”

Mr. Zhao, 46, has responded by hiring compliance officials with government credentials and pledging to help law enforcement agencies stop crypto crimes. Binance executives are meeting with reporters to trumpet the company’s compliance efforts, and the exchange’s U.S. arm has formed a political action committee to push its agenda in Washington.

Mr. Zhao called the C.F.T.C. lawsuit “unexpected and disappointing,” describing it as an “incomplete recitation of facts.” A company spokesman declined to comment on the other investigations. Representatives for the Justice Department, the C.F.T.C. and the S.E.C. also declined to comment.

The increasing pressure on Binance has already sent tremors through the crypto market. The exchange’s U.S. operation recently lost a major banking partner, Signature Bank, when the embattled lender went out of business last month. Binance also lost its outside auditing firm, Mazars, last year after the company said it was pausing work for crypto clients. (The spokesman said Binance had engaged new audit firms but declined to identify them.)

Some of Binance’s customers appear spooked. Over seven days in late March, more than $2 billion in cryptocurrencies built on the popular Ethereum network was withdrawn from the exchange, according to the crypto data tracker Nansen. So far this month, nearly $1 billion has left the platform. Binance still sits on an estimated $66.5 billion in customer holdings, Nansen says.

The C.F.T.C. lawsuit provided a wake-up call about the severity of Binance’s legal situation. The complaint, citing internal texts and emails, argued that the company had allowed criminals to launder funds. Some customers could bypass critical background checks, the complaint said, using loopholes left in place to preserve the exchange’s profits. Privately, Binance employees joked about terrorists moving money on the platform and acknowledged that the company “facilitated potentially illegal activities,” the C.F.T.C. said in its complaint.

Aitan Goelman, a partner at the law firm Zuckerman Spaeder who previously served as the C.F.T.C.’s enforcement director, said the extent of the conduct described in the suit set Binance apart from its crypto peers.

“The misconduct is egregious enough that you would think the Justice Department would be interested,” Mr. Goelman said.

The Justice Department’s criminal investigation is led by its Money Laundering and Asset Recovery Section, three people familiar with the inquiry said. Those officials are working with prosecutors in the U.S. attorney’s office in Seattle, the people said, and the S.E.C. has a parallel investigation. Details of the case were previously reported by Reuters.

Binance has an array of law firms orchestrating its defense. Mr. Zhao has hired at least four Latham & Watkins lawyers, while the company has been represented by a half-dozen Gibson Dunn lawyers in its discussions with the Justice Department and U.S. regulators, according to court records and people with knowledge of the matter.

Founded in 2017, Binance grew rapidly by offering a marketplace for a wide selection of experimental cryptocurrencies and allowing customers to make a type of risky, highly leveraged bet on crypto prices that remains illegal in the United States. About two-thirds of all crypto trades take place on Binance’s platform, according to CCData, a data analysis firm.

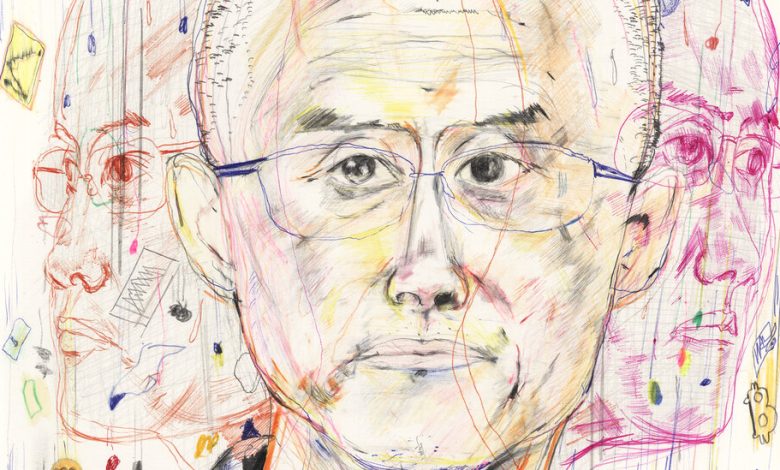

Founded in 2017 by Changpeng Zhao, Binance became the world’s largest crypto exchange.Credit…Darrin Zammit Lupi/Reuters

In the crypto world, Mr. Zhao is just as famous and influential as Mr. Bankman-Fried was before his arrest. But Mr. Zhao, better known in the crypto community as CZ, is a more elusive figure.

A Chinese-born Canadian citizen, Mr. Zhao has hopped from country to country and now largely splits his time between Dubai and Paris, according to a person with knowledge of the matter. Mr. Zhao traveled to the United States at least once in 2022, the person said.

Binance has long been dogged by allegations that it skirted global money-laundering rules and sought to evade regulations in the countries where it operates. At times, the privately-held exchange has operated out of China, Malta and Singapore; a spokesman said the firm now has major regional offices in Dubai and Paris, with 8,000 full-time employees worldwide.

Binance is not authorized to operate in the United States, so Mr. Zhao has a smaller business for American users called Binance.US., which says it functions separately from the global exchange. But the company’s U.S.-based customers have been able to access the main platform using virtual private networks to disguise their whereabouts.

Binance has faced U.S. regulatory scrutiny for years. In February, Patrick Hillmann, its chief strategy officer, revealed the exchange was in talks with regulators about a settlement to resolve the various legal investigations with a fine or some other penalty. He said the company was “highly confident and feeling really good” about the discussions.

A month later, the C.F.T.C. filed its lawsuit.

The agency sued Binance affiliates based in the Cayman Islands and Ireland, saying those corporate entities were “directly or indirectly owned” by Mr. Zhao and linked to dozens of other business entities maintained by the exchange. The complaint said that Mr. Zhao was personally responsible for Binance’s compliance failures, describing a meeting in which he acknowledged the existence of a loophole that let users get around know-your-customer protocols.

The C.F.T.C. also sued Binance’s former top compliance official, Samuel Lim, claiming he had helped American customers evade systems designed to prevent money laundering. A lawyer for Mr. Lim did not respond to requests for comment.

The lawsuit added that Binance allowed three unnamed American trading firms to operate on its platform, despite rules prohibiting U.S. firms from doing so. The firms were Jane Street Group, Tower Research Capital and Radix Trading, according to a person familiar with the matter. There’s no indication that the companies, previously identified by Bloomberg News, are under investigation by federal authorities.

A spokesman for Jane Street declined to comment. Representatives for Radix and Tower Research did not respond to requests for comment.

Allegations that Binance allowed money laundering to proliferate also surfaced in a few private lawsuits, several of which have been dismissed in the courts. Some plaintiffs claim they were scammed by crypto traders who then routed stolen funds through the exchange.

David Silver, a Florida lawyer who sued Binance last year, said the C.F.T.C. suit was likely to be the first of several law enforcement actions against Mr. Zhao’s firm.

“The truth will come out,” Mr. Silver said. “And Binance will be held culpable.”

The Binance spokesman said the firm works “closely with law enforcement to freeze funds that are identified as potentially illicitly gained.” Last year, Binance helped law enforcement “thwart cybercriminals in over 40,000 cases globally,” he said.

Binance has sought to build a more robust compliance infrastructure. The company now has a compliance department of more than 750 employees, the spokesman said, with hundreds of employees hired in the past year. In January, a former federal prosecutor, Noah Perlman, was appointed the new global compliance chief.

Binance has also recruited former law enforcement agents, including Tigran Gambaryan, an ex-Internal Revenue Service investigator who worked on several of the government’s highest-profile early crypto cases.

In an interview, Mr. Gambaryan said the accusations against Binance were remnants of an earlier era when the exchange was a small start-up focused on growth.

Binance “sees itself as a tech company,” he said, adding: “They break things. All the exchanges have done it.”