How Much Higher Are Your Post-Pandemic Property Taxes?

The median price for a single-family home in the United States rose about 40 percent from 2019 to 2022, peaking at $480,000 before receding to about $417,000 at the close of 2023. The higher home prices have led to higher property taxes, adding even more to a monthly housing budget. A recent study by CoreLogic found that from 2019 through 2023, the median U.S. single-family property-tax bill rose by nearly 24 percent, to about $2,826.

Property taxes are determined on the county level, based on a home’s assessed value and the local tax rate. Reassessment timelines differ — taxable home values are determined either at the time of sale, annually, or on another schedule — so the pandemic price increases have affected rates differently depending on location. CoreLogic found that taxes rose 26.3 percent ($612) among homes that were reassessed since 2019, and 18.4 percent ($402) among those that were not. What’s a few hundred dollars over the course of 12 months? Maybe not a deal breaker in lower-cost counties where the tax rates are more manageable.

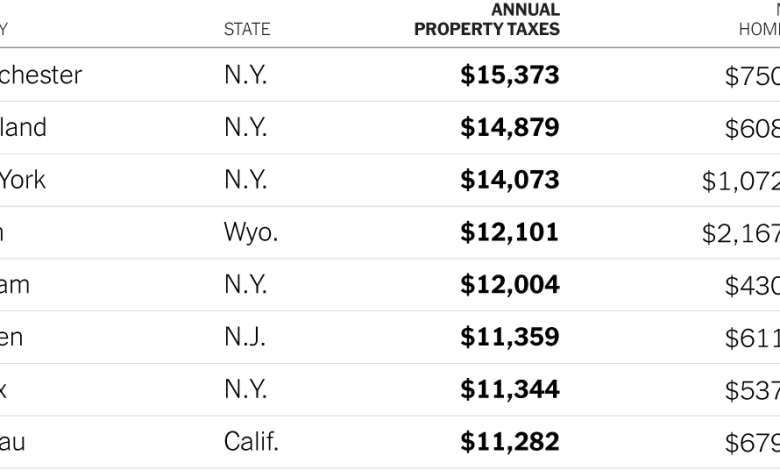

But don’t tell that to homeowners in Westchester, just north of New York City, the most expensive tax county of all. According to a separate CoreLogic study, the median tax bill there in 2023 was $15,373. Just across the Hudson River, Rockland County, N.Y., followed, with $14,879 a year in property taxes; and New York County, otherwise known as Manhattan, had the third-highest taxes, with a median of $14,073 a year.

Overall, the New York City area had the highest taxes in the country, with 13 of the 15 most expensive tax counties located in the city or its suburbs.

This week’s chart shows the 15 counties where property taxes were highest in 2023, and the median home price in each. Teton County, Wyo. — fourth on the list and one of the two counties outside the New York area — offers some insight into how tax rates vary. Its median annual tax amount of $12,101 is based on a median home price of about $2.2 million. In Manhattan (New York County), property taxes were higher (about $14,100 a year) but its median home price was about half of Teton’s.

For weekly email updates on residential real estate news, sign up here.