Where Are the Most and Least Affordable Homes?

If you spend more than 30 percent of your income on your monthly housing payment, you are officially “cost burdened,” according to the Department of Housing and Urban Development (HUD). In December, that threshold was easily surpassed in most large U.S. cities, according to RealtyHop’s December 2022 Housing Affordability Index.

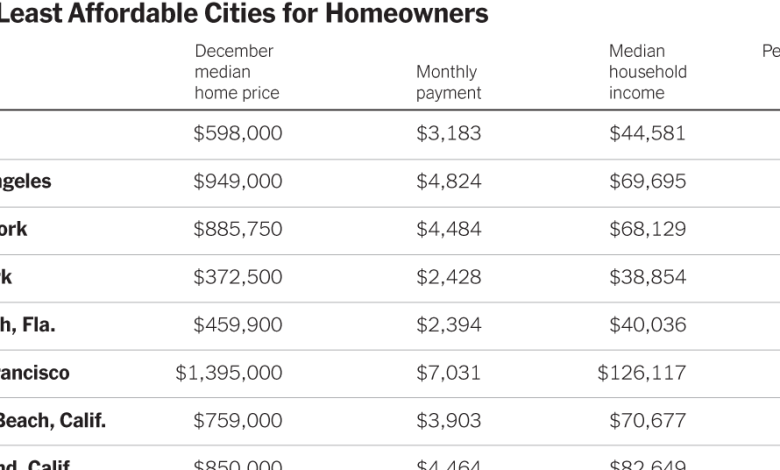

By comparing median home prices against household income, property taxes and mortgage expenses in the 100 largest U.S. cities, the study ranked affordability of homeownership. A 30-year loan at 5.5 percent with a 20 percent down payment was assumed.

Ultimately, 75 of the 100 cities included in the report did not pass muster, requiring more than 30 percent of income to afford a home. The least affordable was Miami, where the median-priced home costs $598,000 and would require a monthly payment of $3,183 to cover mortgage and taxes — more than 85 percent of the local median household income of $44,581 (or $3,715 a month). Los Angeles and New York followed — no surprise given their steep home prices.

At the other end of the scale was Wichita, Kan., where the median-priced home costs just $145,000 and would require a monthly payment of $816 — 16 percent of the local median household income of $59,861. Fort Wayne, Ind., and Detroit were next, helped by their low median home prices ($164,000 and $90,000).

If you’re looking to move, expect competition — even in more affordable cities. Remember, the seller of your dream house probably needs somewhere to go, and will be facing the same challenging real estate market you are.

This week’s chart shows the most and least affordable cities, according to RealtyHop.

For weekly email updates on residential real estate news, sign up here.