How to Beat High Mortgage Interest Rates

It was hard enough for home buyers when the coronavirus pandemic made finding available homes so difficult. Now, with mortgage rates for 30-year, fixed-rate loans climbing over 6 percent in September, from a low of around 2.6 percent at the start of 2021, affording those homes is also much more challenging.

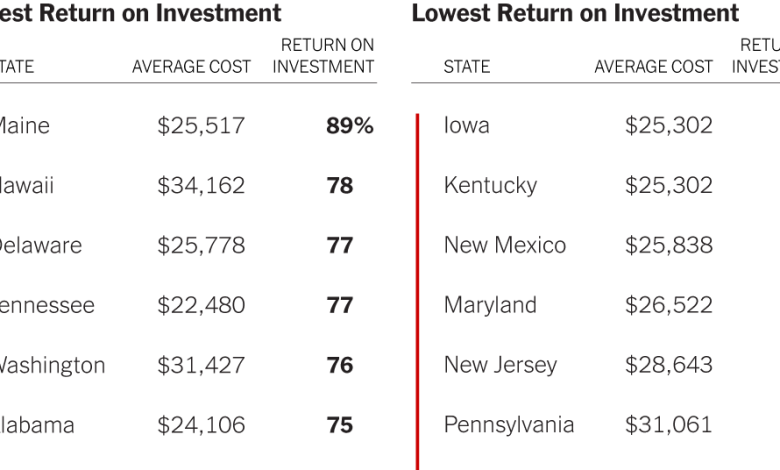

While 30-year, fixed-rate mortgages are the norm, 15-year, fixed-rate loans come with lower rates (though the monthly payments are higher). A recent study by the online loan marketplace LendingTree examined 381,000 loans offered to its users from July to August to compare benefits and costs of 15-year loans in all 50 states.

In pricey California, the average offered loan of $457,965 came with a rate of about 5.9 percent with a 30-year loan, or about 4.9 percent with a 15-year loan — saving $328,064 in interest over the life of the loan. Even in West Virginia, where homeowners benefit the least from 15-year loans, the average loan of $218,480 came with a rate of about 6.3 percent over 30 years, or about 5.4 percent over 15 years, saving $168,946.

Since 15-year loans entail higher individual payments, that explains why less than 10 percent of applicants opt for them, according to LendingTree. But you can still take advantage of lower rates by downsizing your purchase to make a 15-year loan affordable — that way, you’ll still be in the game, building equity.

If you have the cash, you can also make additional payments on your mortgage, whatever its term. By taking extra bites out of what you owe, you’ll ultimately pay off the loan sooner. (Just make sure your loan has no prepayment penalty. Most don’t.)

Finally, remember that you’re never really locked into an interest rate. When rates fall, do the math. Maybe your dream home will have come within reach, or perhaps it’ll make sense to refinance your current home at a lower rate, or for a shorter term.

For weekly email updates on residential real estate news, sign up here. Follow us on Twitter: @nytrealestate.